Telecommunications

Latest News

-

November 2, 1936 - the beginning of television

November 19, 2009An extraordinary library of original files, scripts, letters, diary entries and photographs from the early days of British television went under the hammer in London earlier this year. -

FCC bans AI-voiced robocalls in wake of ‘Biden’ calls to NH residents

February 08, 2024The US Federal Communications Commission (FCC) announced on February 8th that robocalls made using AI-generated voices are illegal, effective immediately. The announcement gives law enforcement agencies greater powers to deal with scammers. -

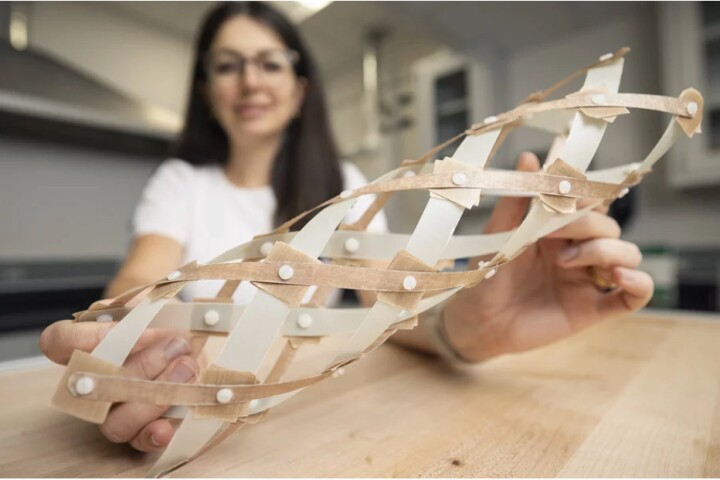

Lightweight woven antenna could replace field-deployed dishes

January 22, 2024Ordinarily, in order to establish communications at disaster sites, rescuers have to transport and set up relatively bulky, costly satellite dishes. Soon, however, a simple tubular antenna made of woven strips of material may get the job done. -

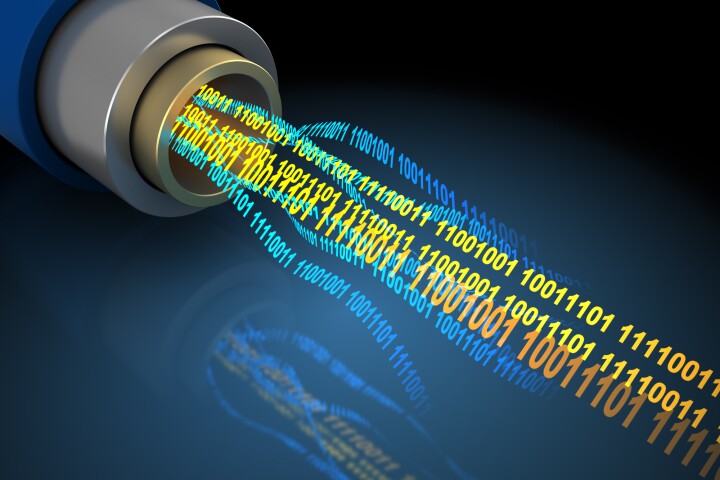

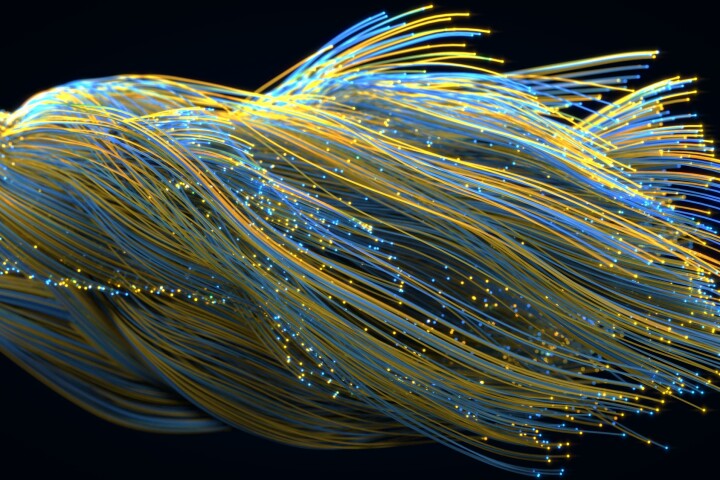

Record-breaking fiber transmits 20x global internet traffic per second

December 03, 2023Everybody wants a faster internet connection, and now engineers in Japan have shattered the record for data transmission. The team managed to transmit more than 20 times the global internet traffic per second through a single optical fiber. -

LG sets new real-world-ready distance record for 6G data transmission

September 26, 2023While 5G feels pretty new and flashy, the industry is already making preparations for the next generation. LG Electronics and the Fraunhofer Institute have now conducted a test that set a new distance record for data transmission using 6G technology. -

Groundbreaking optical fiber blazes new data transmission speed record

June 12, 2023A team of international researchers say they’ve set a new world speed record for an industrial standard optical fiber that’s as thick as a human hair, achieving a data transmission rate of 1.7 Petabits per second over a 41-mile cable. -

Holoportation box is a sign of things to come for ASL learning

April 24, 2023At a teaching symposium earlier this month, the world's only liberal arts university for deaf students explored the potential for remote learning by testing out a life-size holoportation device called the Epic from Proto Inc. -

Logitech debuts Project Ghost videoconferencing booth prototype at ISE 2023

February 03, 2023Video chats came into their own during the COVID-19 pandemic, providing an audiovisual lifeline for fragmented families and remote colleagues in touch. But they seem rather flat compared to Project Ghost presented by Logitech at ISE 2023 this week. -

Laser satellite shatters space-to-Earth data transmission speed record

December 01, 2022A small satellite developed by MIT engineers has set a new record for data transmission between a satellite and Earth. The TeraByte InfraRed Delivery (TBIRD) system used a laser to beam huge amounts of data at up to 100 gigabits per second. -

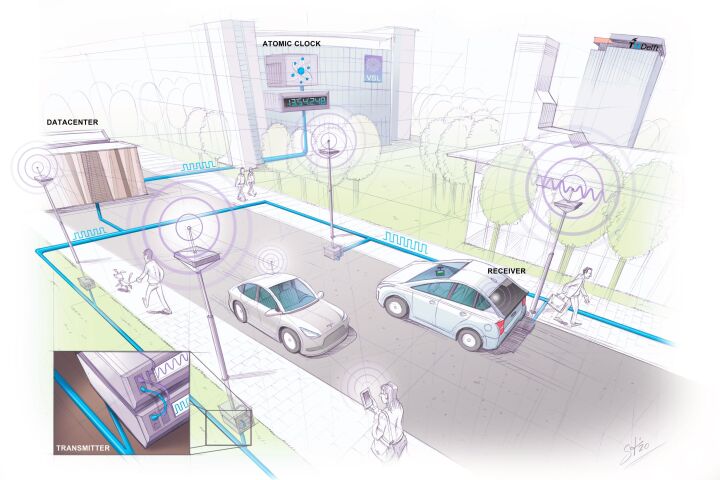

"SuperGPS" ditches satellites for radio towers for cm-scale tracking

November 17, 2022GPS has its limitations in urban areas where signals can get noisy. Now, engineers in the Netherlands have developed “SuperGPS” – a hybrid positioning system that combines wireless and optical connections to pinpoint locations within centimeters. -

Speed record shattered for data transmission over standard optical fiber

November 10, 2022Engineers have set a new speed record for data transmission through a standard diameter optical fiber. By beaming 55 “modes” of signals down a single-core optical fiber, the team was able to transmit at a data rate of 1.53 petabits per second. -

Record-breaking chip can transmit entire internet's traffic per second

October 23, 2022The speed record for data transmission using a single light source and optical chip has been shattered. Engineers have transmitted data at a blistering rate of 1.84 petabits per second (Pbit/s), almost twice the global internet traffic per second. -

"64-dimensional quantum space" drastically boosts quantum computing

October 13, 2022Scientists have demonstrated a technique to allow quantum computers to store more information in photons of light. The team encoded eight levels of data into photons and read it back easily, representing an exponential leap over previous systems. -

World's fastest internet network upgraded to staggering 46 Terabit/s

October 11, 2022The fastest internet network in the US just got a bit faster. The Energy Sciences Network has been upgraded to ESnet6, boasting a blistering bandwidth of 46 Terabits per second (Tbps). But don’t get too excited yet – it’s strictly scientists only. -

SpaceX’s Starlink internet reaches Antarctica, touching all 7 continents

September 15, 2022SpaceX launched its first Starlink satellite in 2019 with a vision of blanketing the globe in high-speed internet, and it has this week ticked off an important milestone in this grand plan, beaming the service down to scientists in Antarctica.

Load More