Science

The latest in science news, from the depths of space to the quantum realm.

Camera captures the world as animals see it, with up to 99% accuracy

January 25, 2024

It’s easy to forget that most animals don’t see the world the way humans do. In fact, many perceive colors that are invisible to us. But now, for the first time, scientists have found a way to capture footage as seen by animals, and it's mesmerizing.

Energy

-

World first energy storage unit demonstrates zero degradation over 5 years

April 15, 2024China's CATL – the world's largest EV battery producer – has launched TENER, which is described as the "world's first mass-producible energy storage system with zero degradation in the first five years of use." -

90-GWh thermal energy storage facility could heat a city for a year

April 09, 2024An energy supplier in Finland has announced the upcoming construction of an underground seasonal thermal energy storage facility about the size of two Madison Square Gardens that could meet the heating demands of a medium-sized city for up to a year. -

Condor-inspired retrofit boosts wind turbine energy production by 10%

April 03, 2024The Andean condor’s drag-reducing aerodynamic wings have inspired the creation of a winglet, which, when added to a wind turbine blade, boosted energy production by an average of 10%, according to a new study.

Load More

Medical

-

Your doctor is prescribing antibiotics that won't help – and may harm

April 23, 2024US doctors haven’t been following the rules when it comes to prescribing antibiotics, according to new research. Despite the rise in antibiotic resistance, between 2017 and 2021 more than a quarter of antibiotics prescribed were for conditions they’re ineffective against. -

How aspirin stops the growth and spread of colorectal cancer

April 23, 2024Aspirin, taken by around 29 million Americans daily, has increasingly been linked to inhibiting the growth of certain cancers – but we didn't quite know how. Now, scientists have uncovered how it helps the immune system see and kill cancer cells. -

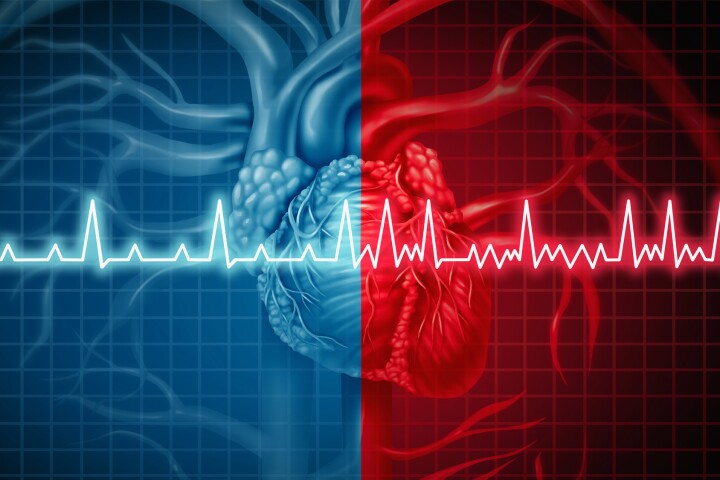

Smartwatch AI predicts atrial fibrillation 30 minutes before it arrives

April 22, 2024Trained on simple heart rate data, an AI model can predict an episode of atrial fibrillation 30 minutes in advance. With plans to incorporate it into a smartphone so it can analyze data from a smartwatch, the model would act as an early warning system.

Load More

Space

-

NASA just hacked a 1977 computer on a spacecraft way out past Pluto

April 23, 2024We have to cut the 47-year-old space veteran some slack – it's faring much better than our 2019 laptops – but Voyager 1's five months of communicating nonsense to Earth may be over, thanks to Mission Control's 15-billion-mile remote IT fix. -

World's most advanced solar sail rockets into space

April 23, 2024The world's most advanced solar sail spacecraft began its epic odyssey as it lifted off atop a Rocket Lab Electron launcher from Launch Complex 1 in Mahia, New Zealand. It was one of two payloads on the Beginning Of The Swarm mission. -

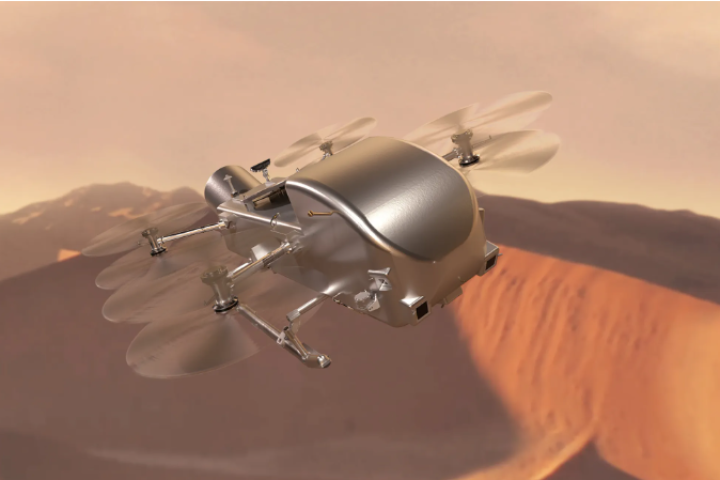

Dragonfly rotorcraft given green light for mission to Titan

April 17, 2024NASA has given the green light for the nuclear-powered Dragonfly rotorcraft to explore Saturn's largest moon, Titan. Approval for the 2028 interplanetary mission comes after years of delay due to COVID-19 and a series of cost overruns.

Load More

Materials

-

Goldene: New 2D form of gold makes graphene look boring

April 16, 2024Graphene is the Novak Djokovic of materials – it’s so damn talented that it’s getting boring celebrating each new victory. But an exciting new upstart is challenging graphene’s title. Meet goldene, a 2D sheet of gold with its own strange properties. -

Graphite platform levitates without power

April 10, 2024Magnetic levitation is used to float things like lamps and trains, but usually it requires a power source. Now, scientists in Japan have developed a way to make a floating platform that requires no external power, out of regular old graphite. -

Harvard's bizarre "metafluid" packs programmable properties

April 09, 2024Harvard engineers have created a strange new “metafluid” – a liquid that can be programmed to change properties, like its compressibility, transparency, viscosity and even whether it’s Newtonian or not.

Load More

Biology

-

Oh great, AI can now mess with our DNA

April 24, 2024Medically, AI is helping us with everything from identifying abnormal heart rhythms before they happen to spotting skin cancer. But do we really need it to get involved with our genome? Protein-design company Profluent believes we do. -

World's largest marine reptile gives blue whale a run for its money

April 22, 2024A newly described species of marine reptile could be the largest to ever swim the world’s oceans. The “giant fish lizard” lived more than 200 million years ago, and may give the blue whale a run for its money, size-wise. -

Two lifeforms merge in once-in-a-billion-years evolutionary event

April 18, 2024Scientists have discovered that a once-in-a-billion-years evolutionary event is underway, as two lifeforms have merged into one organism that boasts abilities its peers would envy. Last time this happened, Earth got plants.

Load More

Environment

-

45% of China's urban land is rapidly sinking due to manmade development

April 18, 2024A perfect storm is brewing for China's cities due rising sea levels and accelerated subsiding land. Scientists have now sounded the alarm that, without intervention, urban areas below sea level will triple by 2120, impacting up to 128 million people. -

Self-dying bacterial black leather paves the way for greener textiles

April 04, 2024Bacteria-produced leather is already an eco-friendly alternative to its cow-derived counterpart, but it could soon be even eco-friendlier. Scientists have gotten the microbes to color the stuff themselves, eliminating the need for toxic dyes. -

"First plastic demonstrated to not create microplastics" has been tested

March 22, 2024Even when it’s ground into microparticles, 97% of an algae-based plastic biodegrades in compost and water in under seven months, a new study has reported. The researchers hope their plastic will eventually replace existing petroleum-based ones.

Load More

Physics

-

Free software lets you design and test warp drives with real physics

April 16, 2024Warp drives are among the more plausible of science fiction concepts, at least from a physics perspective. Now, a group of scientists and engineers has launched open-source software that lets you design and test scientifically accurate warp drives. -

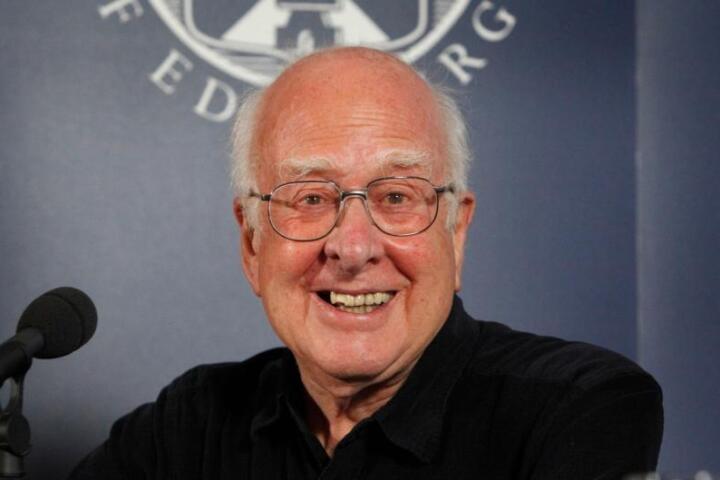

Professor Peter Higgs, renowned for Higgs boson prediction, dies aged 94

April 09, 2024Professor Peter Higgs has died aged 94. The theoretical physicist was best known for his prediction of a key elementary particle, the Higgs boson, which earned him the 2013 Nobel Prize in Physics soon after its discovery. -

Quantum tornado mimics black holes' warped spacetime in the lab

March 21, 2024A giant quantum vortex has been created in superfluid helium in a lab at the University of Nottingham. Its behavior was found to mimic that of black holes and may help astrophysicists gain deeper insight into these galactic gravity gobblers.

Load More

Electronics

-

AI synthesizer bridges technology and creativity in music composition

February 15, 2024SPIN challenges conventional notions of music creation by inviting users to collaborate with an AI language model called MusicGen. With its distinctive blend of a turntable and a drum machine, SPIN offers users a creative music composition tool. -

Eye-tracking window tech tells sightseers about what they're looking at

January 05, 2024If you're on a sightseeing tour in a bus, you really don't want to be looking away from the passing attractions to Google them on your smartphone. The AR Interactive Vehicle Display is intended to help, by showing relevant information on the vehicle's window glass. -

Diamond data storage breakthrough writes and rewrites down to single atom

December 05, 2023Diamond is a promising material for data storage, and now scientists have demonstrated a new way to cram more data onto it, down to a single atom. The technique bypasses a physical limit by writing data to the same spots in different-colored light.

Load More

Quantum Computing

-

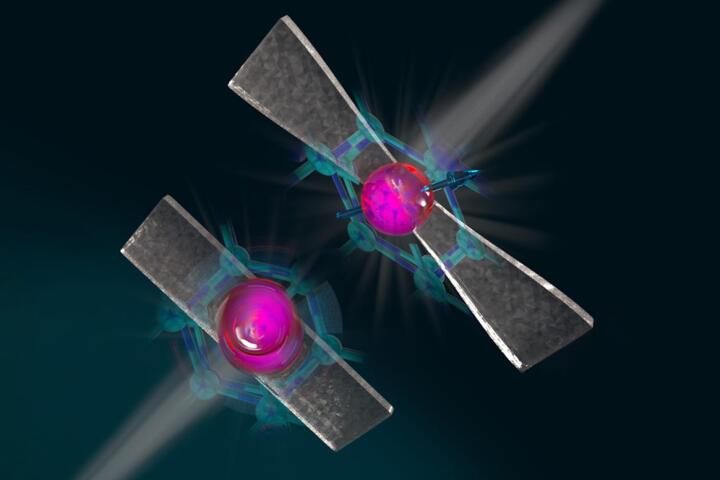

Diamond-stretching technique makes qubits more stable and controllable

November 30, 2023Researchers are claiming a breakthrough in quantum communications, thanks to a new diamond-stretching technique they say greatly increases the temperatures at which qubits remain entangled, while also making them microwave-controllable. -

Perovskite LED unlocks next-level quantum random number generation

September 05, 2023Random numbers are critical to encryption algorithms, but they're nigh-on impossible for computers to generate. Now, Swedish researchers say they've created a new, super-secure quantum random number generator using cheap perovskite LEDs. -

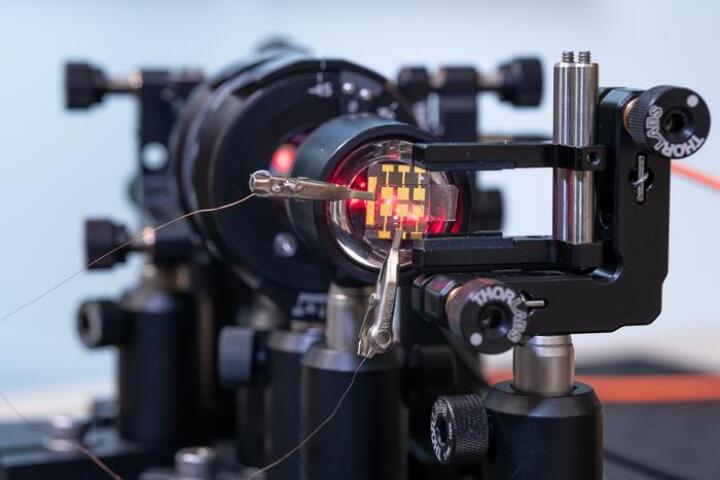

Silicon quantum computing surpasses 99% accuracy in three studies

January 19, 2022Three teams of scientists have achieved a major milestone in quantum computing. All three groups demonstrated better than 99 percent accuracy in silicon-based quantum devices, paving the way for practical, scalable, error-free quantum computers.

Load More