Money is a delusion – but a delusion that works as long as it's shared. The value of a US dollar was once tied to a government guarantee that you could, at any time, exchange it for a quantity of precious metal – but since America officially abandoned the gold standard in 1971, its value is now more or less rooted in its ubiquity. If large swathes of people decided they would no longer accept it, it would suddenly be worth a lot less.

Government currencies like the American dollar are also a bit odd, in that a government can decide to print more money at any time to serve its own purposes. This is very handy for the government, but through inflation it causes each individual dollar to be worth a bit less each time.

It's a problem that will persist with pretty much any currency that's managed by one central organization. And distrust of these organizations is one of the strongest driving forces behind alternative currencies like Bitcoin. The idea is to create an entirely new currency that's widely accepted, fairly stable, and more or less inflation-proof because the money supply can't be increased at the whim of some central figure.

So how do you create a new currency?

The answer, more or less, seems to be that you simply build it, convince people it's worth something, and give them an incentive to get on board.

Bitcoin was first proposed in 2008 – a fortunate time, since faith in the global banking hegemony and government control of money was crashing as the global financial crisis kicked in.

It was designed by "Satoshi Nakamoto" – a pseudonym, possibly for a group of anonymous designers who have never revealed themselves. Bitcoin's key selling points from day one were solid, trustworthy and transparent technology, a controlled money supply and a built-in early adopter bonus that made them very cheap to produce while the currency got off the ground.

The third point is probably the most important; Bitcoins are produced by getting a computer to crunch complex algorithms. Once a certain amount of work is done, you create a brand new bitcoin. That amount of work was very quick and easy early in the piece, so early adopters were able to churn out large numbers of coins. But the algorithms are designed to become progressively more difficult over time, until a point some time around 2040 when the supply will be capped forever at around 21 million bitcoins.

Effectively, if you got in early, you could use your personal computer to churn out thousands of bitcoins – giving early adopters a heavy incentive to find things to do with them. But now, the Bitcoin mining process is already so difficult that you need a specialized rig bristling with dozens of graphics cards to make any decent progress.

This gradual restriction of supply is what Bitcoin advocates maintain makes the currency inflation-proof. There's no such thing as "quantitative easing" in the Bitcoin world. In fact, as the money supply crawls to a stop, the currency should deflate over time, making each bitcoin increase in value.

Of course, it also makes the Bitcoin system look a lot like a pump and dump scam as well – early adopters mined huge amounts of bitcoins early on for very little effort, and stood to gain huge amounts of cold, hard, non-virtual cash if they could convince other people the bitcoin was worth something. But let's backtrack a little before we explore that.

How bitcoins work

The most important feature of a digital unit of currency is that ownership can be authenticated, and the money can't be spent twice. You can ensure this by keeping a central ledger somewhere of who owns exactly which bitcoins – but the genius of the Bitcoin system is that this ledger is completely decentralized and run as a peer-to-peer system like the BitTorrent network.

When you make a transaction, the Bitcoin network sends out a notice and a confirmation process takes place. In this confirmation process, the transaction history of the particular bitcoin being moved is checked against the records of a number of different nodes in the system. Only when several nodes "agree" that the bitcoin is authentic does the actual transfer occur.

A bitcoin itself is just a string of letters and numbers – the system would be vulnerable to all sorts of hacks if it wasn't for this peer-to-peer tracking system. And although the bitcoin's entire transaction history is sent around the network for checking, it's only a series of bitcoin wallet addresses that are used, rather than account names – making it virtually impossible to work out exactly who owned the coin in the real world.

This also makes it virtually impossible to prove you owned a bitcoin if you misplace its alphanumeric code. If you delete your wallet file or forget your passwords, your money is gone forever.

Getting money in and out of the Bitcoin system

First off, you need a wallet. You can either download the original Bitcoin client and run it on your own computer, or you can trust a third party online service like MyWallet to take care of it for you. From there, there's a number of ways to buy bitcoins with regular cash. You can strike a deal directly with another bitcoin owner over at Bitcoin OTC, use a big-time currency exchange like Mt.Gox or any number of others.

If you want to keep your identity as far away from the transaction as possible, you can use a cash deposit service like bitinstant – you notify the service that you want to buy X dollars worth of bitcoins, they give you some deposit details, and you simply walk into a bank (or another deposit location like a 7-11 or Walmart store) and drop off the cash with a given account and reference number. Once the transaction is verified, the bitcoins are transferred to your ownership. The process takes less than an hour and costs you a four percent fee.

To get money out of the system, you've got to effectively sell your bitcoins. The easiest method is probably to register with a big exchange, sell your coins and have them transfer the money to your local bank account.

There's other services that will pay you back through Paypal, vouchers and all sorts of other options – and if you want to keep things totally anonymous, you can always strike a deal directly with somebody who wants to buy the bitcoins, and dodge the transaction fee in the process.

What's a bitcoin worth?

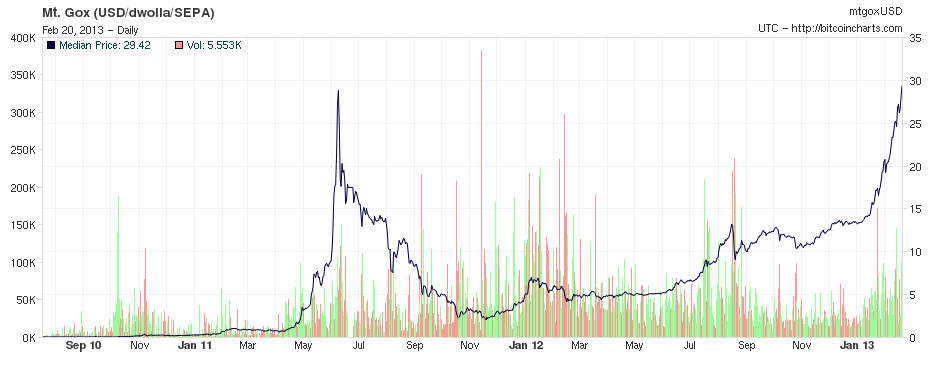

As I write this, close to US$30. Here's a live update. The currency is still pretty volatile, its value changes constantly. If you'd bought yourself a bitcoin in December last year, you'd have doubled your money in the last 50 days.

That's nothing compared to the gains the early adopters have made, though – bitcoins were worth literally nothing back when the system went online in January 2009. They were trading for less than US$0.10 back in September 2010, and only broke the US$1 mark in February 2011. They spiked up to US$27 in May 2011, then crashed down to US$3.50 within a couple of months when Mt.Gox and MyBitcoin were hacked, resulting in a leaking of user information and some straight-up bitcoin theft.

Right now, it's riding higher than it ever has and spiking upwards like crazy, and there's every chance you can still make money as a speculator – as well as every chance that it'll crash again before 2014.

What can you buy with bitcoins?

Lots of things. Bitmit is like a sort of Bitcoin eBay, although its most popular items are cash buybacks, electronics components, video games and the odd porn site membership.

There's a heap of traders that accept Bitcoin payment listed on the Bitcoin wiki, selling everything from photographic services, to pizzas, to coffee beans and hotel stays.

Of course, most people don't get into anonymous crypto-currencies to buy coffee beans. The anonymous nature of the service also opens the door to the online black market, and this is where Bitcoin seems to have made its biggest mark.

Through deep-net, highly encrypted and anonymous sites like Silk Road, you can have an astonishing array of illegal drugs sent straight to your doorstep through the post in virtually undetectable fashion. Silk Road deserves its own article – it's fascinating.

Through other sites, you can order pretty much anything from weapons to the services of a hitman. It's all anonymous, so trust is paramount and there's a lot of scammers out there trying to take you for a ride, as well as plenty of ways to expose yourself to the risk of being caught.

And of course, you can use bitcoins to send money to organizations like Wikileaks or The Pirate Bay, even if payments are blocked by organizations like PayPal or Visa.

Pros and cons of bitcoins

Pros:

- They're more or less anonymous if you take the right precautions, meaning your transactions can't be tracked or taxed

- They will never devalue due to inflation - in fact, a slow process of deflation is built into the algorithm

- There is often no transaction fee when moving bitcoins

- You can buy things with them

- You can trust the authenticity of your bitcoins, and prove your ownership of them

- You can speculate on bitcoin values by buying and selling them as the market fluctuates

Cons:

- Like U.S. dollars, they have no inherent value. If other people don't want them, they're worthless

- Bitcoins will never be any good for over-the-counter or face to face payments, because every time you make a transaction, there's a roughly 10 minute wait as the network validates the bitcoins' ownership. This wait will get longer in the future, too.

- Like cash, if you lose your Bitcoin wallet, you lose your money

- Currently, the most popular uses for bitcoins seem to be speculation, scams, money laundering and black market contraband sales. This is not escaping the attention of the authorities. However, it remains to be seen if they can actually do anything to stop it

- They can be stolen

A couple of final thoughts about Bitcoin

There is definitely money to be made in this system for smart operators. Of all the attempts at creating an anonymous digital currency, Bitcoin is far and away the most successful to date.

But there's still a few reasons, beyond just the bitcoin's volatile value, to pause before you jump in with a substantial amount of your own money.

Firstly, while there are more than 1.8 million registered Bitcoin users, a large amount of the money seems to be concentrated to a few users. We know this, because while it's totally anonymous, you can get a hold of the entire transaction history for the network. In October 2012, this report was released showing that the vast majority of Bitcoin accounts hold very small amounts of money, more than 75 percent of all bitcoins are being hoarded instead of being spent, one anonymous figure holds around 25 percent of all the bitcoins in circulation, 90 percent of Bitcoin traffic seems to be speculative trading and not goods and services purchases, and it seems as if other large holders are trying to shift their bitcoins around a lot to conceal exactly how much they own.

So while Bitcoin advocates point to the fact that the currency is definitely being used for goods and services to prove that it's not some sort of giant Ponzi scheme, it's also irrefutably true that the vast majority of existing bitcoins aren't being used at all. And while the idea of the whole system is to create a currency that's not at the mercy of some central administration, you could easily argue that a few key figures hold a huge amount of power over the bitcoin's value.

Secondly, if one person or group were to control enough "nodes" of the Bitcoin checking system, it's theoretically possible for that group to change the rules and start fraudulently awarding itself money. You'd need to control a lot of the network to make it happen ... But then, according to some sources Deepbit's mining collective already clears more than a third of all Bitcoin transactions.

And thirdly, there is an awful lot of genuinely dodgy stuff going on in this system. From hacking and theft, through scams and money laundering, to illegal contraband sales, there's a reasonable chance that any bitcoin you buy is directly or indirectly helping bad guys do business. But then, it's up to you whether that's better or worse than giving your cash to a national government, isn't it?